Every year, like clockwork, retailers slash prices on Black Friday to entice shoppers to wake up at 4:00am and spend hours chasing bargains. We’ve often wondered: Why don’t investors treat market declines like sales at their favorite stores?

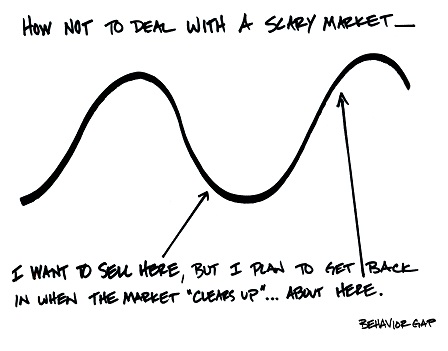

Investing 101 teaches us to buy low and sell high. Unfortunately, as the graphic to the left depicts, irrational behavior often leads investors to do just the opposite – it’s like rushing to buy something you want after prices have been marked up!

While the amount of money you may spend on Black Friday pales in comparison to the value of your investment portfolio, the underlying concepts of the two scenarios are the same. So, why do investors tend to act irrationally in the short-term? This is the essence of behavioral finance, a relatively new field that seeks to understand how the emotions and psychology of human behavior influence financial decisions.

WHY INVESTORS ACT IRRATIONALLY

Here are some behavioral biases that we humans are predisposed to and should be mindful of overcoming.

1. The tendency to extrapolate recent events into the future indefinitely

Recency bias is the belief that if the market is hot, it will continue to be so. Consider, for example, the internet/technology bubble at the turn of the century. Similarly, if the market is in free fall, it seems as though there is no bottom in sight – think about the Great Recession. Of course, we all know better, yet the more extreme the rise or fall, the more people tend to jump on the bandwagon. Surely there will be ups and downs – we shouldn’t expect otherwise – but human nature leads many investors astray time and again.

2. The loathing of losses

Academic studies of the concept of loss aversion suggest that losses are felt two to two-and-a-half times as strongly as gains. For example, one who loses $1,000 will feel significantly more emotional pain than they would feel satisfaction from a $1,000 gain. This may lead an investor to do whatever they can to avoid a loss, even if it does not make logical sense.

3. The tendency to collect information that confirms our beliefs

We like to think we are objective and that we carefully gather and evaluate facts and data before reaching a conclusion. But we don’t. Instead, we reach a pre-conceived conclusion and then hunt for facts to support that narrative. This is called confirmation bias. And modern technology only makes this worse. A simple internet search – “why we’re due for a recession,” for example, or “how a market decline is around the corner” – yields hundreds of results that can further entrench a given belief and lead us to think reacting to this guess would be productive.

In an academic setting, or exploratory article, this all makes sense. Why would anyone fall victim to these behavioral obstacles? Of course, the reality of life – living through the daily fire hose of information – can all too often change our state of thinking and ability to rationalize. We are always calm during planned fire drills. How we react to an actual fire can be quite different.

HOW TO MAKE PRUDENT INVESTMENT DECISIONS

1. Have a well-designed financial plan

We believe once you have built a well-designed financial plan and a portfolio aligned with your interests and goals, behaving is what matters. Behavior often determines investment success. While it feels good to “do something” or “take action” during a big news announcement or financial shock, it’s more often both ill-timed and ill-advised. More importantly, it’s a distraction from the long-term focus of the plan.

2. Expect financial “storms”

We like the analogy of planting a new tree. You’ve thought about where to plant it and what the future may look like once fully grown. So surely you wouldn’t dig it up after a thunderstorm to see how the roots are doing. That’s counterproductive and may end up killing the tree – or at least stunting its growth. Periods of financial chaos, like storms, are part of life and should be expected. But they’re not a reason to change your long-term strategy.

3. Don’t try to make sense of day-to-day market movements

While it’s human nature to seek understanding of how things work and to boil everything down to a predictable science, investing just doesn’t work that way. Markets, much like weather, are difficult to predict. And while it can be entertaining to have an opinion on where markets are headed, it’s nothing more than a guess. The truth is, nobody knows. Nobody knows what events are going to transpire and what the market’s reaction to those events will be.

Next time a friend or family member is running for the exits when the market sells off, remind them that trying to make sense of day-to-day market movements is a waste of time and energy. Worse yet, it is a distraction from achieving their long-term goals. Ask them how they respond to sales on Black Friday. What is most important is developing a sound plan – and sticking to it!